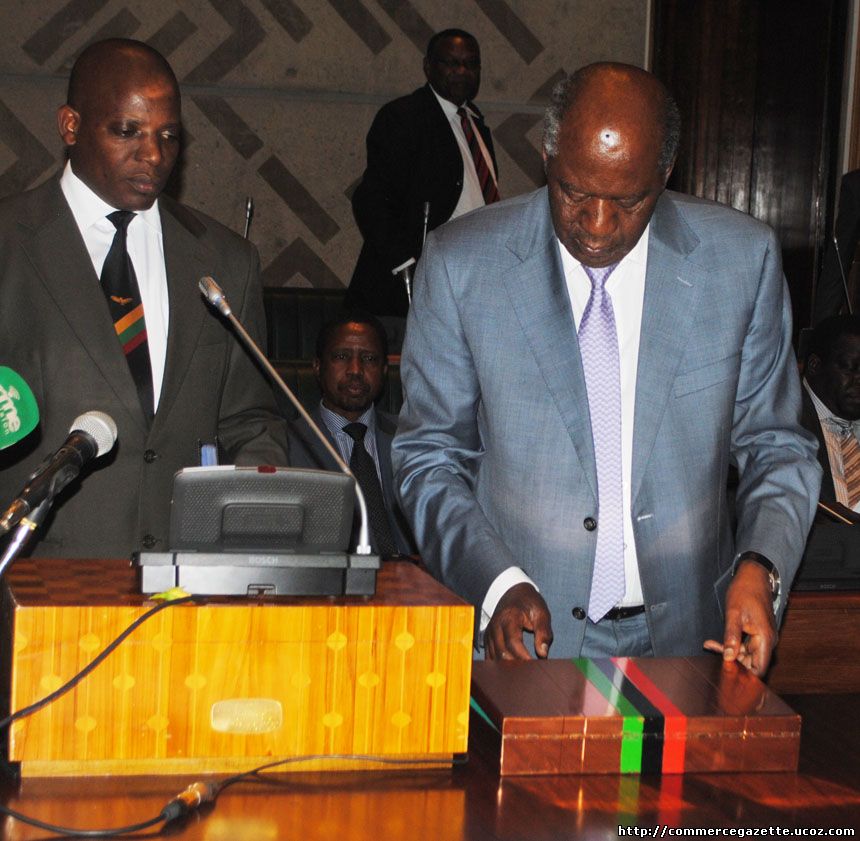

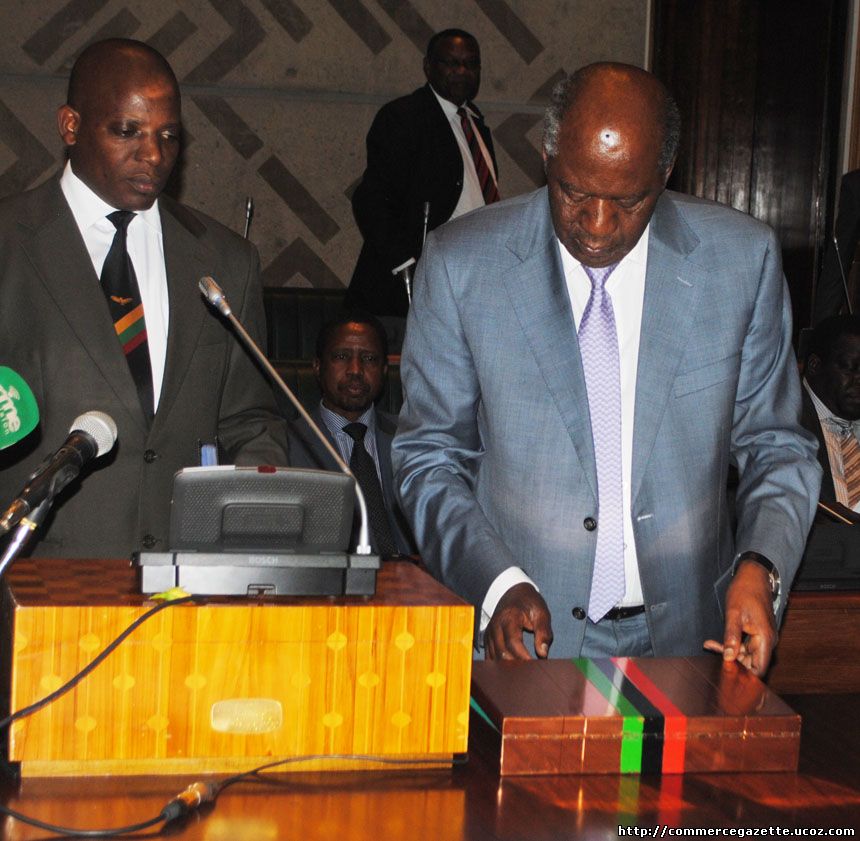

| Zambia’s minister of Finance, Hon Alexander B. Chikwanda presented the National Budget for 2014 whose theme is ‘Moving Forward to Consolidate Growth and Social Justice in Peace and Unity.

The Budget, which was presented, in four parts continues to seek to deliver on the Patriotic Front (PF) government’s campaign promise – to deliver a more fair distribution of the nation’s wealth.

Looking back at the PF’s performance so far, critics can describe it as a mixed bag of good intentions and promises that wait to be realized. Assessing PF’s overall performance since assuming power two years ago, the are two policies that have had the most impact on people lives and business performance are the increase of the minimum wage (2012 Budget) and the removal of fuel and maize subsidies (2013 Budget).

|

2014 Budget Highlights

Part I: Overview of the global and domestic economies

The minister highlighted that:

• The global economy continues to slowly recover with growth in 2013 projected at 2.9 percent.

• Commodity prices have generally been lower in 2013 relative to 2012 due to sluggish growth in the world economy.

• Copper prices remain high whilst oil prices have generally stabilised.

• Projected GDP remained strong at above 6 percent. This is on account of favourable performance in the mining, construction,

manufacturing, transport and communication sectors.

• The banking sector remains favourable.

• The external sector has improved.

• Exports of gemstones, cement, electricity, sugar, tobacco, cotton lint, maize and maize seed all registered strong growth.

• The stock of Government’s external debt has increased marginally by 1.8 percent. Interest payments on Government bonds have

increased.

• he government approved the issuance of bonds by the International Finance Corporation and the African Development Bank to support the

private sector.

• The Cheque Truncation System became operational on 1st February 2013, with all commercial banks expected to re-engineer their systems

by February 2014.

• Government issued Statutory Instrument Number 55 to facilitate better monitoring of financial flows between Zambia and the rest of the

world.

Part II: Macroeconomic objectives, policies and strategies for 2014 and the medium term Macroeconomic objectives for 2014 include:

• Achieve real GDP growth rate of above 7 percent.

• Create at least 200 000 decent jobs.

• Attain end year inflation of no more than 6.5 percent.

• Increase international reserves to over 3 months of import cover.

• Maintain a fiscally sustainable public external debt level so that debt service and amortisation do not exceed 30 percent of domestic

revenues.

• Increase domestic revenue collections to over 21 percent of GDP.

• Limit domestic borrowing to 2.5 percent of GDP and contain the overall deficit to no more than 6.6 percent of GDP.

The government has formulated a National Strategy for Industrialisation and Job Creation with a focus on agriculture, tourism, manufacturing, energy and construction sectors.

Part III: The 2014 Budget Expenditure

Government proposes to spend ZMW42.68 billion, which is 30.7 percent of GDP. A total of ZMW 29.54 billion will be financed from domestic revenues, ZMW 2.63 billion will be financed from grants and loans, while the balance will be financed through foreign and domestic borrowing.

The key revenue mobilisation measures include:

• Increase in excise duty on airtime from 10 percent to 15 percent.

• Revoke the Statutory Instrument that suspended excise duty on clear beer so that the substantive duty rate of 60 percent is once again

effective.

• Increase the property transfer tax from 5 percent to 10 percent.

• Introduction of a charge of 0.2 percent of the value transferred on money transfer service to a recipient within or outside the Republic of

Zambia.

The above measures will take effect on 1 January 2014.

Rationalisation of the tax system

• Expand the Value Added Tax base by shifting several categories of zero rated goods and services to the standard rated category.

• Extend the withholding tax to profits distributed by branches of foreign companies.

• Increase withholding tax on commissions, public entertainment fees and payments made to non- resident contractors to 20 percent from

15 percent.

• Reduction of withholding tax on rental income from 15 percent to 10 percent and make this a final tax.

• Exemption from withholding tax on interest arising from the debenture part of a property linked unit paid to Zambian investors in any

Property Loan Stock Company listed on Lusaka Stock Exchange.

• Introduction of the withholding tax of 20 percent on winnings from gaming, lotteries and betting and make it a final tax.

• Increase of the PAYE exemption threshold from ZMW 2,200 to ZMW 3,000.

• Monetary transfer services within and outside Zambia are now subject to a charge of 0.2 percent of the value of the transfer.

Streamlining of tax incentives

• Exemption from paying duty for first five years by investors who pledge to invest at least US$500 million in a priority sector, as well as

preferential income tax rates for a further five year period.

Macro economic objectives, policies and strategies for 2014 and the medium term

Macro-economic objectives

The development plan for the year 2014 is in line with the government’s development agenda. At the centre of the plan is an ambitious job creation agenda. The rebasing of the country’s national accounts is being concluded. This will provide a more accurate measurement of the economy and facilitate better informed economic policies and decision making.

|

|